Executive Summary

- Battlefield assessment: Despite heavy combat, battle lines remained relatively stable.

- Rafales to Ukraine: France agreed to provide Ukraine with a large contingent of Dassault Rafale combat aircraft.

- Heavy air strikes: Ukraine struck Russian territory with tactical ballistic missiles supplied by the United States. Moscow hit Myrnohrad with FAB-3000 glide bombs.

- Moscow-Pyongyang cooperation: The Russian Ministry of Defense released a video of North Korean sappers clearing mines in the Russian region of Kursk.

- What to watch for: (1) Heavy armor movements signaling a breakthrough in Pokrovsk, (2) increased FAB-3000 strikes, and (3) expanded North Korean troop movements.

1. Battlefield Assessment

Over the past six days, Russian forces have aggressively attempted to fracture Ukrainian defenses around Pokrovsk from both the northern and southern axes.

Rather than relying on large, mechanized combat formations, the Russian high command is pushing numerous infantry assault groups to infiltrate Ukrainian positions. These formations, supported by massed glide bomb and artillery strikes, have used small-unit tactics and continuous rotations to overwhelm Ukraine’s defensive positions.

Russia’s immediate objective appears to be to reach Hryshyne, a village northwest of Pokrovsk. A Russian success would complicate Ukrainian resupply efforts and set the stage for deeper pushes toward the rear area. Nearby in Myrnohrad, open-source intelligence suggests Russia has used three-ton FAB-3000 glide bombs on urban targets.

Elsewhere, battle lines remained relatively stable despite an average of 150 tactical engagements per day. Russian forces continued to launch positional attacks on the Lyman, Sloviansk, Kupiansk, Zaporizhzhia, and lower Dnipro sectors. These engagements, though intense, produced no strategic breakthroughs. Deteriorating weather, shrinking daylight hours, and deepening mud slowed maneuvers—though not enough to halt Russia’s attempts to lock in territorial advantages before winter comes in full force.

Notably, the Russian Ministry of Defense released images of North Korean sappers clearing minefields in the Kursk region of Russia. Additionally, Ukraine’s defense intelligence agency predicts that North Korea will soon send more than 10,000 workers to the joint Russia-Iran drone plant in the Russian Republic of Tatarstan. This report will continue to monitor Pyongyang’s personnel deployments.

2. Air Warfare and Drone Update

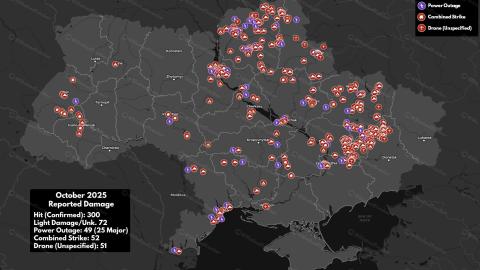

Moscow and Kyiv continued to conduct dueling long-range strikes: Russia is working to degrade Ukraine’s energy infrastructure, while Ukraine is targeting Russian military and industrial assets. Over the past several weeks, Russia has increased the volume of its missile and drone strikes against Ukraine’s power generation facilities and transmission lines, causing power shortages across the country.

Russian Shahed Strikes, October 2025

Map via Shahed Tracker (@ShahedTracker) on X.

Kyiv responded by expanding its own deep-strike operations. Ukrainian forces struck thermal power plants in the occupied Donetsk region and used indigenous jet-powered drones to hit a major oil refinery in Samara Oblast. Ukraine also struck targets inside Russia with US-provided Army Tactical Missile Systems (ATACMS) following Washington’s decision to remove geographic restrictions on American weapons.

Both sides continued to advance their unmanned systems programs. Ukraine continued to use its new STING drone-hunting loitering munitions to counter Shahed drones. Meanwhile the Russian military tested a new unmanned ground vehicle (UGV), the Courier. This new UGV is a multiple-launch rocket system (MLRS) that fires Shmel thermobaric munitions, which Russia has already used extensively in Ukraine. It could prove deadly in urban and semi-urban settings.

A Visual of the Courier UGV

Image via Informant (@Осведомитель) on Telegram.

3. France to Provide Ukraine Rafale Combat Aircraft

Last week French President Emmanuel Macron hosted Ukrainian President Volodymyr Zelenskyy at Vélizy-Villacoublay Air Base near Paris to sign a major defense cooperation pact.

The new agreement, potentially the most significant security arrangement between Paris and Kyiv since Russia’s full-scale invasion of Ukraine, aims to bolster Ukraine’s air deterrent for the long term. The deal commits Paris to supplying Ukraine with up to 100 Rafale F4 fighters, SAMP/T air-defense systems, high-end radars, and precision weapons. These acquisitions would steer Kyiv further toward a North Atlantic Treaty Organization–standard air combat infrastructure.

The Ukrainian Air Force seems intent on organizing its doctrinal order of battle around two principal platforms: the French Dassault Rafale and Swedish Saab Gripen. Notably, Kyiv would be the only country to operate both aircraft. Though Ukraine has yet to finalize its purchase of either, this deal brings Ukraine one step closer to possessing one of the most sophisticated—and expensive—aerial combat systems in Europe.

But Ukraine is likely to face challenges in acquiring Rafales—and the cost of the jets is just the beginning. The United Arab Emirates paid around $19 billion for 80 of the aircraft in 2021. France has suggested that Ukraine could finance the deal through European Union programs using revenue from frozen Russian assets. But Brussels has not yet finalized the mechanisms for such funding, and France itself is dealing with political and budgetary turbulence.

Beyond the initial cost, operating and sustaining a force of more than 200 fourth-generation fighters for decades requires significant financial, industrial, and military resources. Ukraine would need to stand up new pilot and maintenance pipelines and build the necessary basing infrastructure.

Similar complications surround Kyiv’s attempts to buy the Swedish Gripen. Kyiv’s letter of intent stipulates the purchase of 100 to 150 aircraft. Yet Stockholm estimates it will take at least three years for newly manufactured Gripen E aircraft to arrive. Zelenskyy’s push for delivery in 2026 would therefore require Kyiv to purchase used C- or D-series variants of the airframe.

France has not yet offered Ukraine any secondhand Rafales. Moreover, Dassault’s Rafale production line already faces unprecedented global demand. As a result, its delivery timelines may slip and sustainment costs could climb. Ukraine needs to assess Dassault’s production bottlenecks carefully as it seeks to build its air deterrent under wartime pressure.

4. What to Monitor in the Coming Weeks

- The scale of Russian combat formations in Pokrovsk: Any Russian attempts to transition from small infantry assault squads to larger heavy-armor formations would suggest a decisive breakthrough of Ukraine’s first lines of defense and could signal follow-on piercing moves.

- FAB-3000 glide bomb attacks: The FAB-3000 is Russia’s most destructive glide bomb. A systematic campaign using the munition would further attrit Ukraine’s defenses in the east.

- North Korean troops beyond Kursk: The Kremlin’s information distribution is highly choreographed. The Russian MoD’s decision to release images of North Korean sapper units in Kursk therefore has a distinct purpose. The focus on these units could set the stage for a larger movement of North Korean troops.